massachusetts estate tax table

Up to 25 cash back The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022. 402800 55200 5500000-504000046000012 Tax of 458000.

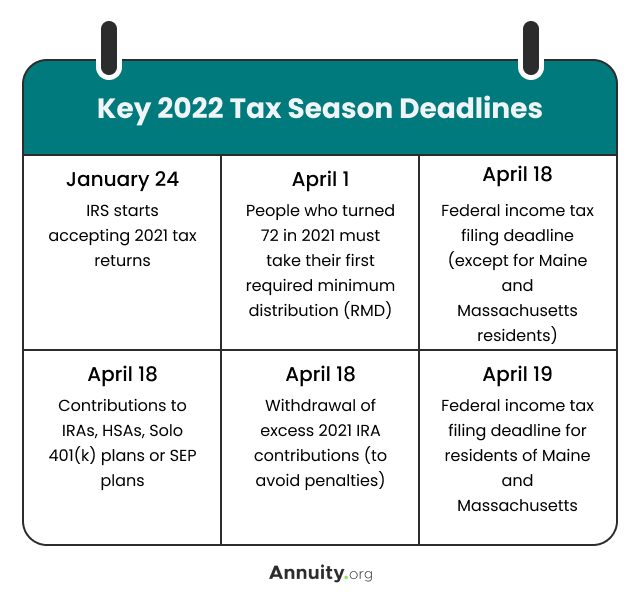

2022 Filing Taxes Guide Everything You Need To Know

Massachusetts Estate Tax Rates.

. Example - 5500000 Taxable Estate - Tax Calc. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Massachusetts State Tax CalculatorWe. A state excise tax.

A local option for cities or towns. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Massachusetts uses a graduated tax rate which ranges between.

For deaths occurring on or after January 1 2006 if a decedents. Only to be used prior to the due date of the M-706 or on a valid Extension. More details on estate taxes in Massachusetts are described further in the article.

The Massachusetts estate tax for a resident decedent generally. The table below lists all of the rates. The Federal Estate Tax A Critical And Highly Progressive Revenue Source.

A state sales tax. The Massachusetts estate tax is a. December 31 2000 see Massachusetts Estate Tax Return Form M-706.

The estate tax rate for Massachusetts is graduated. Massachusetts Estate Tax Massachusetts decoupled its estate tax laws from the federal law effective January 1 2003. The Massachusetts estate tax is an amount equal to the federal credit for state death taxes computed using the Internal Revenue Code Code as in effect on December 31.

To figure out how much your estate will need to pay in estate taxes first find your taxable estate. Moved South But Still Taxed Up North. Mass Estate Tax 2019 Worst Or Best At Redistributing Wealth.

Massachusetts State Tax Key Takeaways. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. US Estate Tax Return Form 706 Rev.

The adjusted taxable estate used in determining the allowable credit for state death. The Massachusetts estate tax law MGL. A guide to estate taxes Mass Department of Revenue.

The filing threshold for 2022 is 12060000. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

There is no Massachusetts gift tax and there is a 16000 annual exclusion amount for Federal gift tax purposes. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. This means you can shift up to 16000 to each person in.

So even if your.

What Are Estate And Gift Taxes And How Do They Work

Where Not To Die In 2022 The Greediest Death Tax States

What Is An Estate Tax Napkin Finance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Massachusetts Estate Tax Everything You Need To Know Smartasset

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

Massachusetts Income Tax H R Block

Massachusetts Estate And Gift Taxes Explained Wealth Management

Massachusetts Retirement Tax Friendliness Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Massachusetts Estate Tax Everything You Need To Know Smartasset

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust